Financial technology solutions have greatly simplified our lives in many aspects. About a decade ago, you would have to go to a bank branch and wait in the queue to make basic transactions like paying bills, transferring money, or depositing your funds. Complex deals like investing money or signing insurance contracts would usually take weeks or months. Compared to Internet banking, Mobile Banking Application Development is a far more convenient and user-centric.

Nowadays, with just a tap of your finger in mobile banking software, you can make your life a lot easier. In this article, we will guide you through what you need to know before starting your Mobile Banking Application Development.

1. What Is A Banking App?

A banking app is a mobile app where you can access your bank account’s details and complete transactions directly from your phone, tablet, or mobile device. Based on the bank you’re accessing, you’ll be able to complete a variety of actions via your banking app.

Most banking apps allow you to view your current balance and transaction history; deposit checks up to a specific dollar value. Another thing you can do is to initiate transfers to other bank accounts, schedule payments or pay your bills, send person-to-person payments, and locate ATMs that are free for you to use.

2. Why You Should Build A Mobile Banking App?

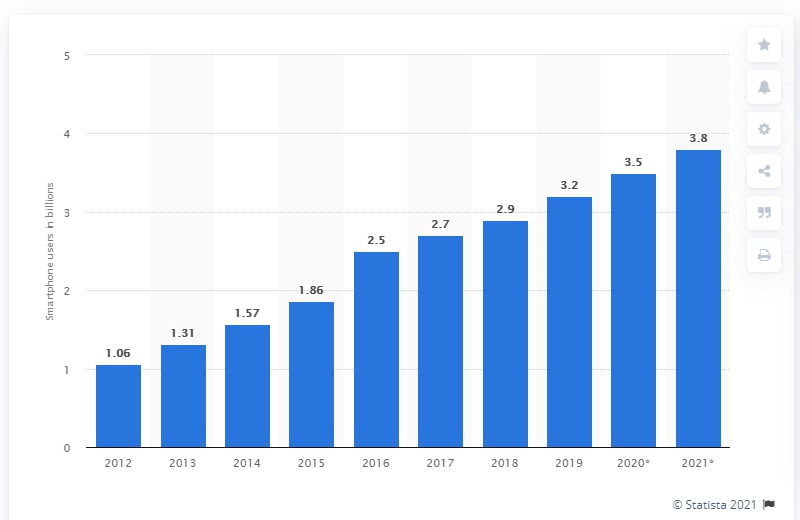

Imagine that almost one-third (32%) of the global population utilizes mobile banking software. Mobile Banking App is something that you cannot miss on your phone and here are the reason why:

- The share of mobile traffic is going to grow up to 63.4% in 2019, which indicates even a greater shift from desktops to smartphones usage. – Statista

- 36% of respondents consider mobile banking as the most favourite activity, which means every third person with a smartphone in their hands is verifying deposit or transferring funds – Statisa

- The Millennials tend to use mobile apps more frequently than other generations. If your services are geared towards the younger generation, you should take notice.

- 33% of respondents admit that mobile experience is the key reason why they stay with a current bank.

3. Benefits & Advantages of Mobile Banking Application Development

A mobile banking app is a free but essential tool that can be used by clients at their convenience. Besides that, investing in mobile banking application development gives a significant advantage in cost reduction for banking institutions. This is a win-win situation for both sides of the process. Let’s review all the benefits in detail.

The benefits of developing a mobile banking application are as follows

- Availability 24×7 – Clients can perform their usual banking operations anytime and anywhere compared with traditional banks and ATMs.

- Variety Of Services & Functions – Top banking apps allow users to carry out almost all banking operations. Among these actions are loan tackings, payroll services, mobile check deposits, savings, etc.

- Less Time Consuming – Clients do not have time to visit a bank and wait in line to cash checks or for consultation.

- Paperless Record Keeping – By utilizing mobile banking development wisely, a financial institution can communicate with its clients and cover legal issues digitally. On the one hand, this reduces bureaucracy, and on the other hand, clients do not have to disclose their sensitive information on paper.

- Reduction In Customer Service Costs – Mobile banking technology reduces the cost of customer services by 50-70%, according to McKinsey research.

- Increased Security – Top banks value their reputation and thus want to ensure that their IT infrastructure and client software use encryption and security protocols to protect customer privacy and information integrity.

- Personalized User Control – Clients can keep track of their expenditures and manage their finances more efficiently.

Mobile Banking Application Development provides valuable advantages for both the bank and the client.

4. Mobile Banking Development Trends

To get the best outcome from mobile banking application development, let’s examine the current market tendencies, what customers demand from banking software.

4.1. Mobile Banking Trends

Below are the key findings of various studies about mobile banking development that are useful to pay attention to:

- Statista reports that in the US, 48% of respondents aged 18-24 use mobile bankings apps at least once a week while 24% of people in their thirties do it a few times a month.

- 1.75 billion users will conduct banking operations via their mobile devices in 2019 – Jupiter

- The value of mobile payment transactions reached $78.09B in the USA in 2018. This sum is expected to increase to $189.97B by 2021 – Statista

- The leading global banks have invested almost $80M in, and have launched 606, mobile banking applications – Exicon

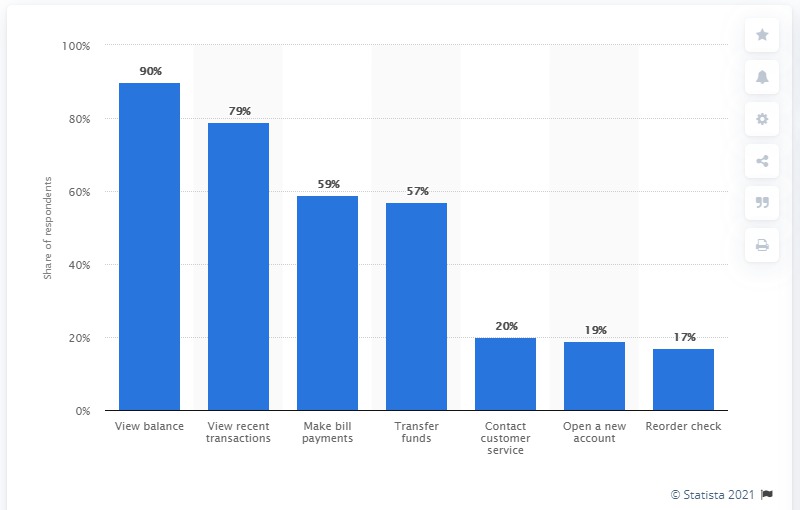

- The most common reason to use a mobile banking app in the United States in 2019 was to view an account balance. – Statista

4.2. Target Audience of Mobile Banking Development

Nowadays, smartphones have become more accessible in almost every part of the world, thanks to low-cost budget phone series even from the most popular vendor like Apple with their iPhone XR or Samsung with their Samsung Galaxy A Series. These markets have started to invest heavily in mobile banking development.

The markets in Asia and Africa have had a boost of 50% among the inhabitants who utilize banking applications. The McKinsey mentioned above study notes that even impoverished people in the Philippines showed a surprisingly high interest in mobile banking technology.

These days, the highest growth in acceptance of modern banking can be observed in emerging markets, namely:

- Southeast Asia – The number of users of digital banking has doubled over the past three years here. Countries like Malaysia, Singapore, Cambodia, Laos, the Philippines, and Vietnam, and Indonesia will adopt more mobile banking services in the nearest future.

- Latin America – The market has not yet exploited the advantages of mobile banking. Banks have only just begun to digitize their services. The number of banking apps users is predicted to account for 47% of the population in 2019.

- Eastern Europe – The most adoptive market of financial mobile applications currently, and this trend is still growing.

There is often an assumption that the target audience of banking apps are tech-savvy millennials, but you might be surprised by the real result.

45% of Baby Boomers (People who were born from 1946 to 1964) between the ages of 50 and 60 actively use online smart banking apps. iPads and tablets are their second most used devices.

The younger generation is pretty demanding of technology and, at the same time, the most engaging group. In 2016, a poll conducted by MX Technology identified that 60% of users are prone to switch to another bank if a mobile banking service is inefficient.

So, what do users expect from mobile banking application development? According to a Federal Reserve Board report in 2016, the most common operations performed with apps for banking are as follows:

- 94% of users check their account balance and recent transactions

- 61% transfer money between bank accounts

- 57% receive alerts from their banks

- 48% deposit checks electronically with the help of a device’s camera

- 48% use an app or banking website to pay their bills

- 40% find the closest ATM or bank branch

- 25% transfer money to another person’s account

All in all, by 2017, the number of clients engaging with apps for banking or online banking had increased from 27% to 46%. This means that the financial sector has undergone changes characterized by reducing human interactions like visiting a branch or contacting a call center. And with the recent development regarding Covid-19 and the global pandemic, people are more likely to stay at home instead of going to a local bank.

4.3. Best Banking Apps of 2020

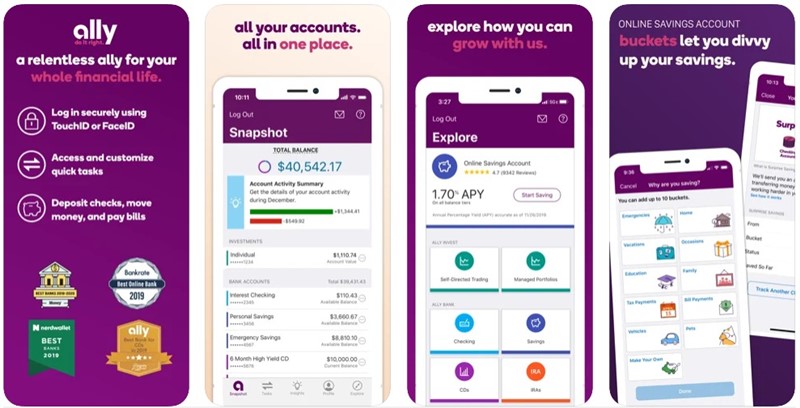

Ally Mobile puts everyday banking and investing tasks at your fingertips.

So what is now considered a cutting-edge mobile banking application? Some apps let you track accounts from different financial institutions. Others offer built-in financial wellness and budgeting platforms. Some even turn your mobile device into a digital wallet.

It’s an exciting time in the world of mobile banking, and if mobile offerings are a deciding factor for you in choosing a bank, we’ve assembled this list of the best banking apps.

- Ally Bank: Best Online Mobile Banking App

- Capital One: Best Mobile Banking App in Customer Service

- Bank of America: Best Mobile Banking App for Security

- Simple: Best Mobile Banking App for Money Management

- Wells Fargo: Best Mobile Banking App for Monitoring Investments

- Chase: Best Mobile Banking App for Prepaid Cards

- Chime: Best Mobile Banking App User Experience

- Discover: Best Mobile Banking App for Rewards

- PNC Bank: Best Mobile Banking App for Cardless Purchases

- Charles Schwab: Best Mobile Banking App for Managing Multiple Accounts

5. Functionalities for Mobile Banking Application Development

For efficient mobile banking application development, most users (86%) are interested in two features – checking balances and exchanging funds between accounts.

5.1. Essential Features of Mobile Banking

The general features used in mobile banking development that are hard-to-avoid are as follows:

- Account creation

It is imperative to build a secure and quick authorization process. Multi-factor authentication is a safe sign-in option but takes some time to fill in the necessary information.

Alternatively, biometric authentication using physical user metrics (appearance, voice, even gestures) is far quicker and even fun.

A MasterCard study indicates that users have become more willing to use personal biometrics as their passwords. The Wells Fargo app has a verification feature that scans the iris of their corporate customers.

- Account management

This point may include a range of mobile banking features. Users can check their cards, bank accounts, review account balance and record history, etc.

It is even possible to implement some additional functionality. For instance, the ABN AMRO Bank in the Netherlands included a unique mobile banking feature for personalized account management.

This feature allows users to set a savings goal, create investment plans, and perform repeat payments.

- Customer support

Being able to provide constant support is one of the core mobile banking features, as the client should be able to address a bank representative and ask questions 24/7. Alternatively, it is possible to advance and personalize the user experience by using Artificial Intelligence in a chatbot.

- ATM & bank branch locations

Mobile Banking Application Development should not skip this fundamental feature of mobile banking services. In order to improve the user experience, it is possible to apply VR technology. This is a unique feature of mobile banking implemented by RBC. It allowed the bank to increase the number of its app downloads tremendously.

- Secure payments and transactions

P2P transactions, payments for services, and fund exchanges should be processed securely and conducted anytime and anywhere with the help of a banking app.

An alternative variant of this feature in mobile banking application development is using QR codes for goods and services payments. Scanning QR codes is a fast and easy way to conduct these operations inside the app. Only a few banks have offered this mobile banking feature to their clients.

- Push notifications

Mobile banking application development should utilize reminders and alerts to increase customer engagement and app promotion. It is necessary to control this aspect and plan the communication strategy with your client in advance because most users would not appreciate receiving intrusive notifications.

5.2. Extra Mobile Banking Features

The app features mentioned earlier create the core of mobile banking application development. To increase user traction and interest, you should be thinking about some innovative mobile banking features which might ultimately be the deciding factor of your app likes:

- Spending trackers

Mobile banking development should focus on user needs, even if they are not explicit. This functionality can control personal budgets and set some goals for desired purchases. The system can create a customized dashboard based on user information, give necessary motivation, and inform users regarding progress.

Alternatively, users can set some scheduled payments and bills in advance not to miss an important transaction. This mobile banking feature is utilized in a significant way in the Simple App. The app is used to track spending habits, plan budgets, and save on each expense.

- Cash back service

M-commerce sales increased to 300M in 2017, and the sum is expected to more than double in 2019. Therefore, with the cashback possibility, users are stimulated to use your bank account to pay for services and goods. This small feature or promotion can be an excellent foundation for your loyalty program. Soon, this mobile banking feature will be included in the majority of banking apps.

- Personalized offers

It makes sense to create special offers, discounts, or coupons with a mobile banking app. The opportunity lies in partnering with restaurants, cafes, coffee houses, and so on for the provision of particular discounts or coupons. This feature stimulates sales and, at the same time, engages the user with your mobile banking software.

- Unique services

Mobile banking application development can include other non-traditional services. These services can consist of purchasing tickets, ordering a taxi, reserving a table, delivery, and more.

For example, a Polish bank (Zachodni WBK) reached out to new users with the functionality of paying for public transport, shopping, and taxi-hailing directly from its mobile app.

- App for smartwatches

Smartwatches have begun to substitute smartphones in many operations. Why not consider developing a banking application for these wearables?

The Australian Bank of Melbourne was the first to create a banking app for smartwatches. The functionality included payments for services and goods, receiving notifications, balance checking, and finding ATMs.

- Finance sharing feature

Visa research indicates that to attract Millenials, it makes sense to concentrate on mobile banking application development for budgeting. This mobile banking app may include sharing finances and splitting bills.

For instance, the app from Emirates NBD has a bill-splitting feature where each user has to include some sum and indicate the number of people participating in the operation via social networks.

Final recommendation: It is better to develop a couple of apps with distinct mobile banking features rather than complex software with lots of operations, details, and data. Try to ask your target users about their priorities in banking procedures and focus on providing a solution for them first.

6. Mobile Banking Application Development Processes

6.1. Conduct Research And Make A Plan

The preliminary stage is crucial and shouldn’t be skipped at any cost. The first task is to conduct market research. You need to identify your competitors, check alternative solutions on the market, and learn what is popular among the crowd. Without doing this, you may go in the wrong direction.

Once you’ve got the research results, continue with defining your target audience. Your application may be for corporate clients, families, individuals, or institutions. Knowing your clientele will help you find out their pain points, which are crucial for sketching an app toolkit.

In this step, you should make a detailed plan for mobile banking development, including expenditure projections that will become a foundation for your budget.

6.2. Create A Prototype

Every Application starts with an idea in your mind. To turn it into reality, you need to create a sketch or prototype explaining in general terms the structure and order of design elements, visuals, and content. You may start with low-fidelity wireframing to sketch a home screen, users’ accounts, personal dashboards, and the layout for a landing page.

As a rule, wireframes consist of boxes, lines, and texts made in the white and black color scheme. You can use an app wireframe to validate your concept and collect early feedback. Next, you can turn your wireframe into a hi-fi prototype that will include a graphic presentation of a product, layout, interface components, the color scheme, and micro-interactions.

Just like wireframes, use your app prototype to demonstrate its toolkit to your focus group, test functionality, and interface. You can add default texts, placeholders, and test data so that people can feel how your app works.

6.3. Make A Graphic Design

Be ready for hard work in this step as your app’s design is its business card that should be recognizable. There are tons of tips on how to make a perfect design for a mobile application. We have created a shortlist of essential recommendations. Check them below.

- make sure that typography, icons, color palette, buttons, and forms of your solution match your corporate style and brand;

- the navigation should reflect the logical architecture of your solution;

- all the design elements – buttons, links, forms, icons – should be clear and comprehensive;

- choose colors, images, video files that evoke certain emotions and feelings;

- consider cultural differences if you’re going to operate globally;

- adjust your app to iOS and Android standards to efficiently market it earlier on;

- your app icon should be unique and make your solution stand out;

- think about extra bells and whistles like sticker packs for messengers.

6.4. Choose A Technology Stack

When choosing a technology stack for your Mobile Banking App, you should concentrate on four areas: front-end, back-end, cross-platform frameworks, and other prerequisites such as robustness and security. Make a checklist that would include the following criteria

- project scope, complexity, and scalability;

- the number of specialists and the level of their competence;

- necessary tools and software;

- outside solutions;

- docs and specs.

There are different kinds of applications: native apps, hybrid solutions, cross-platform applications. Each has its pros and cons and unique features. Native apps are robust and demonstrate high performance. They’re ideal for an established business. Native apps allow specialists to use the native functionality of Android and iOS devices without utilizing third-party APIs.

Hybrid apps are developed using web technologies and can be built for different platforms thanks to a unified codebase. Based on HTML, CSS, and JavaScript, hybrid apps can function as progressive web apps.

6.5. Develop And Test

The most efficient mobile banking app development path you can choose from is contacting an outsourced team. If your idea is brand-new and requires a custom approach, you can’t do it without external help.

The development process allows building a well-thought-out architecture, developing life-like user paths and journeys, creating a user-friendly interface that won’t have analogs, and choosing a technology stack that suits best. The most challenging part is to get a team together, as the quality of work will influence the overall outcome.

6.6. Market Your App And Get Feedback

The most popular app marketplaces – Google Play Market, AppStore, and Microsoft Store – have different requirements for applications you should follow to avoid rejection. In case you opt for an outsourcing team, you can be sure that your off-the-shelf product will adhere to these standards by default.

6.7. Improve And Update

The app launch is just the beginning. To get valuable feedback and learn what to improve and update, ask the mobile audience for feedback, contact app review sources, ask influencers and bloggers to test your product.

If you focus on Apple users, you may submit your application to Apple’s editorial team to get an expert review. Another good idea is to apply your app to Top Apps lists or mobile app awards.

Once you’ve got feedback, you can define the weak and vital aspects of your product and decide how to make it better.

7. Mobile Banking Application Development Cost

application development, ranges from $200,000 to $500,000

However, the cost of making an app depends on its processes and features. We will give you a rough estimation of how much it will take for you to build a mobile banking application.

You may wonder why banks are investing in mobile banking application development. This is the most efficient method of customer engagement, which definitely outweighs the traditional methods that still involve resellers, support staff, and agents. As well, mobile banking development acts as an effective communication point with the possibility to get up-to-date market insights and improve banking services.

7.1. Discovery

We conduct a thorough business analysis to determine how the app will work in detail, what users can do, and whether third-party services are required.

What you get: functional specification with user flows, diagrams, and wireframes.

Cost: USD 2,400 – 3,200.

7.2. UI/UX Design

Based on the user flows and features we determine during the discovery stage, we’ll come up with user experience design to make sure we’ve covered all the business requirements and user needs at the same time. Then we’ll produce a user interface design of the app that includes the visual representation.

What you get: high-fidelity prototypes ready for implementation, along with a style guide.

Cost: USD 16,800 – 24,800.

7.3. Web Development

Mobile apps require administration and it’s usually a web-based admin dashboard.

What you get: a user-friendly admin back-office with functionality to manage the mobile app.

Cost: USD 135,000 – 153,000.

7.4. Mobile Development

We develop an API to communicate with the server-based app developed in Phase 3.1 and put all things together: design, functionality, API.

What you get: a fully-working app ready to upload on Google Play Market or AppStore.

Cost: USD 45,000 – 64,000.

In general, mobile banking development and all mobile app development services can be split into two stages, Discovery and Development. The discovery stage includes all the preparatory work for the project performed by a business analyst, who is responsible for the development of your app from a business perspective, and a software architect, who aligns business aspects with technical implementation.

8. How to Create a Mobile Banking App Project Successfully

It is absolutely certain that the banking sector will only become more and more digital. Mobile banking application development allows the industry to increase efficiency in operations, reduce bureaucracy, and enhance customer experience while promoting banking services. So what makes a good banking application?

Applicable and user-friendly functionality that is secure and easy to access. These can include, but may not be limited to:

- Checking the account balance without login

- Integrations with device info and tools (e.g. address book)

- User customization based on recent actions and regular transactions

- Customizable offers

- Creation of personalized and useful notifications

Application of advanced, innovative technologies like AI, Big Data, AR, VR, and Blockchain to enhance the user experience

Adding new functionality and scale software in accordance with upcoming mobile banking trends, namely:

- Use of voice user interface (VUI) to increase customer engagement

- Use of artificial intelligence and machine learning for self-service in banking industry

- Use of advanced verification technology with biometrics to avoid data breaches

All this shows that mobile banking application development offers many opportunities to create a customer-centric experience in the banking sphere. This niche still has room for useful banking apps, so it is time to plan yours today.

Contact our team in case you are interested in this topic and desire to build your own mobile banking application

- Message us

- Phone: +84 888 780 670

- Email: [email protected]

- Visit our website!